A new wave in private wealth investment and why Switzerland is key

2024 Allocation trends

European allocators to private markets are immensely diverse, however a couple of trends emerged over the year. According to Rede Partners, a leading fundraiser for private markets, sophisticated allocators rotated their allocations away from legacy relationships, taking time to identify new strategies, niches as well as new GPs. Access to middle-market opportunities, often with a thematic bent, and secondaries (across the full private market spectrum) are recurring themes. In addition, the growth in family offices, both in number and in volume, is a trend observed across the region and particularly in Switzerland. At Mont-Fort, we observed this trend as well with increased demand for the Swiss representation and distribution services coming from GPs specifically targeting the wealth management.

Swiss Investor Market Opportunity Set

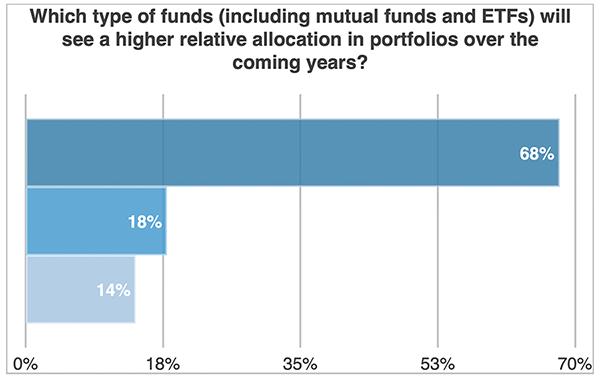

Citywire, in a survey of Swiss-based CIOs in the wealth management channel and released in October 2024, showed that the highest increase in expected allocations over the coming years would be to private markets, by a long shot, as shown in the chart hereunder.

Source: CityWire

In Deloitte’s recently released International Wealth Management Centre Ranking, appears at the top of the list as the largest booking center for International wealth management, at USD 2.2 trillion, as well as being the leader in terms of competitiveness.

Compared to other major wealth-management markets around the globe, Switzerland can point to long-standing presence of diverse and sophisticated investors accustomed to investing in alternative assets. Not least because of the existing knowledge and familiarity with alternatives amongst investors and advisors, Switzerland is a prime target for private market funds looking to tap private wealth channels.

The opportunity set in Switzerland is real. Major private market platforms have opened local sales offices. An increasingly broad range of managers and strategies target the Swiss wealth management channel, raising capital from family offices, high net worth individuals, as well as the more traditional private wealth channels.

Should you wish to learn more about this opportunity set, require more information on the Swiss regulatory framework enabling compliant access to this investor base, please contact us.

Private Markets – new product structures emerging

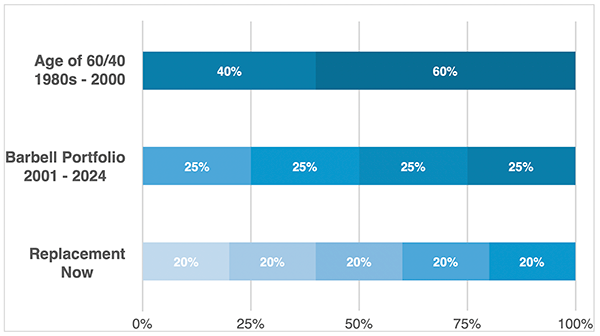

The attraction of private markets over the past decade has profoundly shaped asset allocation within institutional investors’ portfolios. The following chart, an extract from Apollo’s 2024 Investor Day presentation illustrates this evolution of portfolios, with an increased shift over time from public markets into private markets, referred to as replacement:

Source: Apollo

The impact of the increased allocations to private markets can be observed on several levels. Private markets have traditionally been accessible only to investors able to lock their capital up for 10 years or more. A proliferation of new product structures is aiming to enable a broader category of investors to access private markets. Evergreen, semi-liquid and open-ended structures opens access new client segments both in the institutional and wealth management channel.

Preqin recently stated that approximately 200 new funds targeting private wealth have launched in recent years, managing a total of about $400 billion in assets. Large firms are launching new products for private wealth, and technology platforms are making access easier.

Switzerland, as a leading private wealth market, should be on any fundraiser’s radar screen to tap into this still nascent, but enormous opportunity.

Mont-Fort Funds Update

In early July Mont-Fort Funds AG underwent a change in ownership, with Banque Cantonale de Genève (BCGE) in Switzerland acquiring 100% of the company’s share capital. Mont-Fort will become a subsidiary of BCGE whilst remaining independent from the bank. There are no operational changes foreseen. The existing management team remains in place and looks forward to serving clients in the usual efficient manner. The new institutional shareholder will enable the company to accelerate its development by providing additional services and streamlining paying agent services for Mont-Fort clients.

Please contact us for any questions you may have regarding this transaction.

Delegated distribution – In the EU as well as Switzerland

Mont-Fort assists its fund management clients in accessing Swiss and EU investors whilst ensuring regulatory compliance. In Switzerland, delegation of the initial outreach to prospective investors can be done by Mont-Fort, allowing you to not take on the client advisor register requirements whilst remaining fully complaint with Swiss rules when reaching out to opting-out professional investors. For more information, please reach out to us here.

Within the European Union, Mont-Fort offers a regulatory solution for distribution through a Joint Venture with a MIFID-licensed entity in Luxembourg. This delegation model enables fundraising teams outside the EU to market their AIFs to EU clients in a MIFID-compliant manner. Over EUR 2.5 billion has been raised in the last 24 months using this setup. For more information, please reach out to us here.