Mont-Fort Funds Update

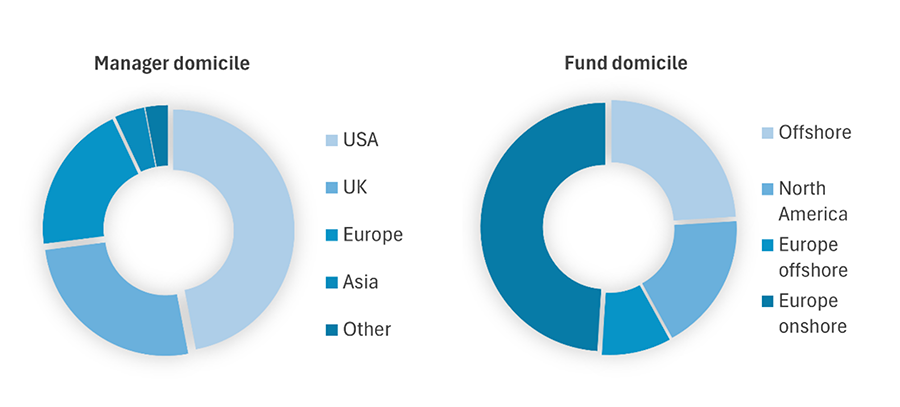

Two years after the updated Swiss financial services regulation took effect, the customary regulatory clarity normally prevailing in Switzerland has now returned. Since 2014, Mont-Fort Funds has been a specialist provider to alternative investment funds. Our client base includes many of the world’s largest and most esteemed managers. The diversity of it can be seen below and underlines how the Swiss regulation is open to any and all types of managers and their funds:

The Swiss investor market remains an attractive destination for alternative investment funds looking to raise assets. This is also a reflection of the investor landscape in Switzerland, with its diverse wealth management channels, numerous family offices of various sizes and structures as well as a high proportion of HNWI. Within these channels, the necessity for Swiss fund representatives and paying agents remain.

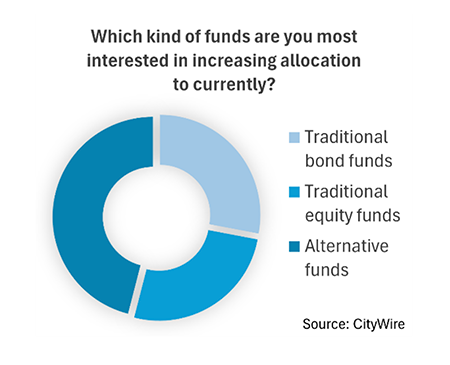

According to Citywire’s March 2024 poll of Swiss-based fund selectors of wealth management channels, appetite for alternatives is strong:

Send us an email if you are interested in learning more about the investor landscape as well as the regulatory compliance framework for Switzerland.

Private Markets

Private equity has found traction again. After a couple of calm quarters, markets seem reassured that the interest rate environment is more predictable and potentially lower later in the year. Additionally, private wealth channels are an attractive area in which to raise capital, in an increasingly competitive environment for fund raising. As private wealth channels have become more and more familiarized and attracted to the idea of investing in private markets, the proposed structures to access this investor segment have increased in number and format as well – evergreen funds, evolving ELTIF 2.0 regulation, as well as various platforms, securitized notes and certificate offerings. In February, Preqin stated that they had seen the number of evergreen funds doubling over a five-year period. Of the funds in their database of approx. 520 funds, the cumulative assets amounted to at least USD 350 B.

Reach out to us here if you would like to hear about the evergreen funds that are offered to investors in Switzerland and represented by Mont-Fort Funds.

Swiss demand for healthcare funds

Mont-Fort Funds strives to service its clients as best as possible, connecting them as necessary to optimize their distribution strategies. One support service that is much appreciated is matching placement agents and third-party marketers with fund managers looking for appropriate and targeted distribution channels beyond what they may already have in place. We currently have a Swiss-based placement agent with a strong track record of private equity placement across Switzerland and the EU (non-UK) looking for a mid-market PE healthcare specialist. If interested, please reach out to us here.

Delegated distribution – In the EU as well as Switzerland

Mont-Fort assists its clients in accessing investors ensuring regulatory compliance. In Switzerland, delegation of the initial outreach to prospective investors can be done by Mont-Fort, allowing you to not take on the client advisor register requirements whilst remaining fully complaint with Swiss rules when reaching out to opting-out professional investors. For more information please reach out to us here.

Within the European Union, Mont-Fort offers a regulatory solution for distribution through a Joint Venture with a MIFID-licensed entity in Luxembourg. This delegation model enables fundraising teams outside the EU to market their AIFs to EU clients in a MIFID-compliant manner. Over EUR 2.5 billion has been raised in the last 24 months using this setup. For more information please reach out to us here.